nj property tax relief homestead benefit

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. For information call 888-238-1233.

Itemized Deductions Nj Property Tax Deduction Credit Pub 4012 Tab F Pub 17 Chapters 21 Through 29 Nj Special Handling Federal 1040 Line 40 Schedule Ppt Download

You can get information on the status amount of your.

. You owned and occupied a home in New Jersey that was your principal residence on October 1 2018. To file an application online or get more information click here. 150000 or less for homeowners age 65 or over or blind.

Homeowners and certain tenants may be eligible. But literally in the center top of the check under trenton new jersey 08695 it says property tax relief. Most eligible homeowners received their 2016 Homestead Benefit property tax relief around May 1 2019 in the form of a.

The following chart shows the mailing schedule for the 2018 Homestead Benefit filing information packets. Check Your Eligibility Today. The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on.

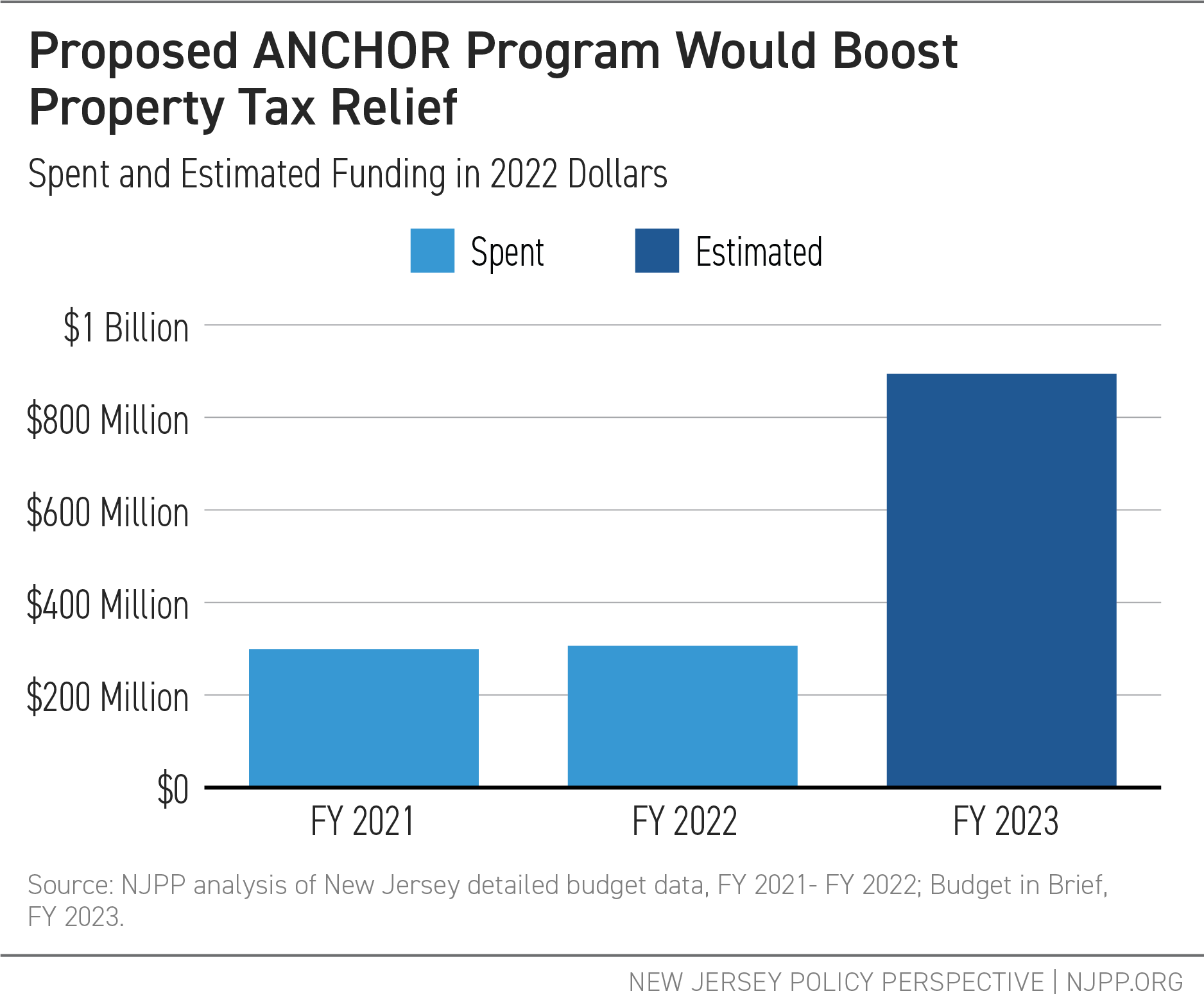

In June New Jersey lawmakers revealed a new budget that will expand property tax relief for residents. Mortgage Relief Program is Giving 3708 Back to Homeowners. If your primary residence is in New Jersey and you paid your property taxes in the year you may be able to get a tax credit of up to 1000.

For most homeowners the benefit is distributed to the municipality in the. Gross Income Limits. Forms are sent out by the State in mid-April.

Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by replacing the states Homestead Benefit. For New Jersey homeowners making up to 250000 rebates would be applied as a percentage of property taxes paid up to 10000. Mailing Expected to Begin.

Check the Status of your Homestead Benefit 2018 Homestead Benefit. 150000 65Over or Disabled. We can deduct any amount you owe from future Homestead Benefits or Income Tax refunds or credits before we issue the payment.

If you did not receive a 2018 Homestead Benefit. Check Your Eligibility Today. About the Homestead Benefit.

State of NJ Homestead Benefit. Information regarding the Homestead Benefit can be found on the State of New Jersey website. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov. Property must be your principal residence. The additions to the existing Homestead Benefit Act focus on low-income.

The homestead benefit program provides property tax relief to eligible homeowners. Email Delivery Expected to Begin. Information regarding the Property Tax Reimbursement PTR Senior.

Certain seniordisabled homeowners who were not. Qualifications Remain the Same. The Homestead Benefit Program.

See Homestead Benefit Program for more information or you can call 1-888-238-1233 Monday through Friday except State holidays. Phil Murphy unveiled Thursday. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. To apply for the refund complete and submit the. General qualifications are as follows.

Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. Currently the average property tax benefit is 626 with eligibility limited to homeowners making 75000 or less if theyre under 65 and not blind or disabled. Check Your Eligibility Today.

All property tax relief program information provided. New Jerseys Homestead Benefit program provides property tax relief to eligible homeowners. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

The Homestead Benefit program provides property tax relief to eligible homeowners. Check the Status of your Homestead Benefit. Also asked is there a NJ Homestead Rebate for 2019.

Renters making up to 100000 would be. 75000 Everyone.

Itemized Deductions Nj Property Tax Deduction Credit Pub 4012 Tab F Pub 17 Chapters 21 Through 29 Nj Special Handling Federal 1040 Line 40 Schedule Ppt Download

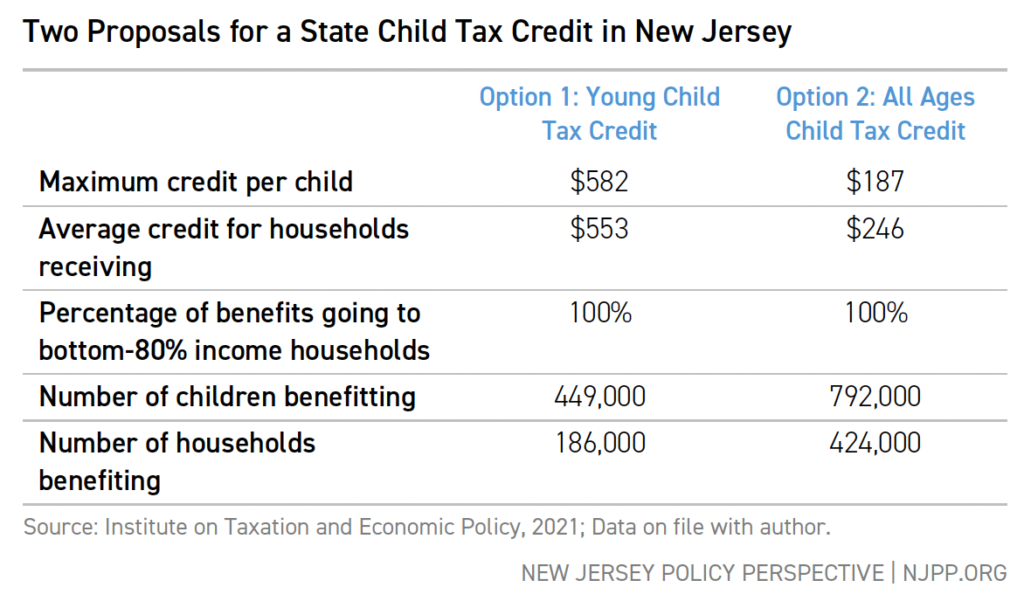

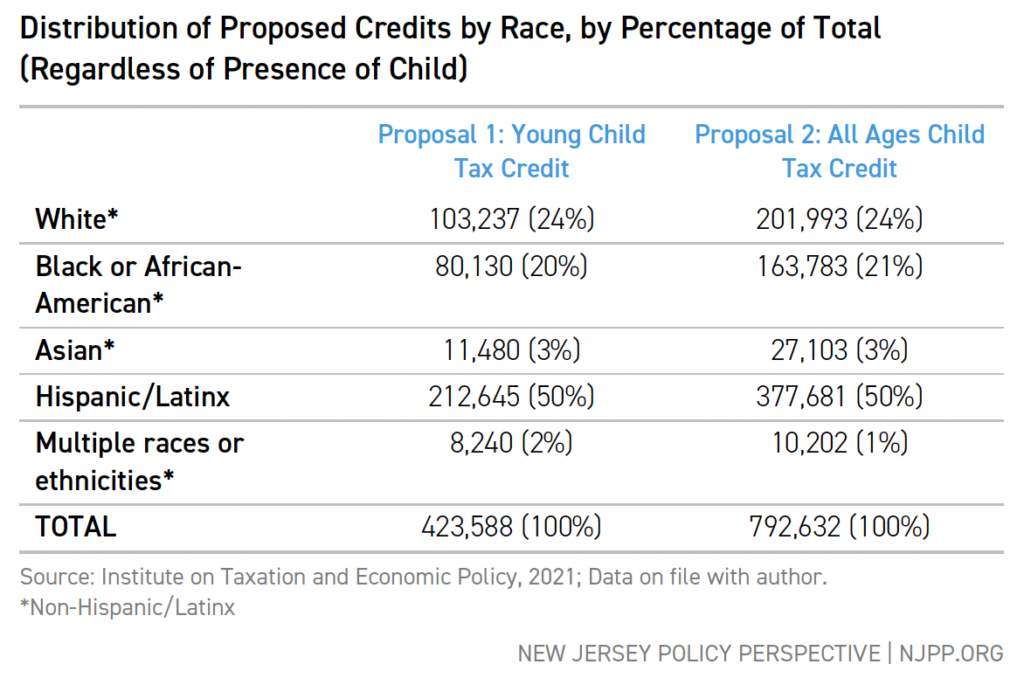

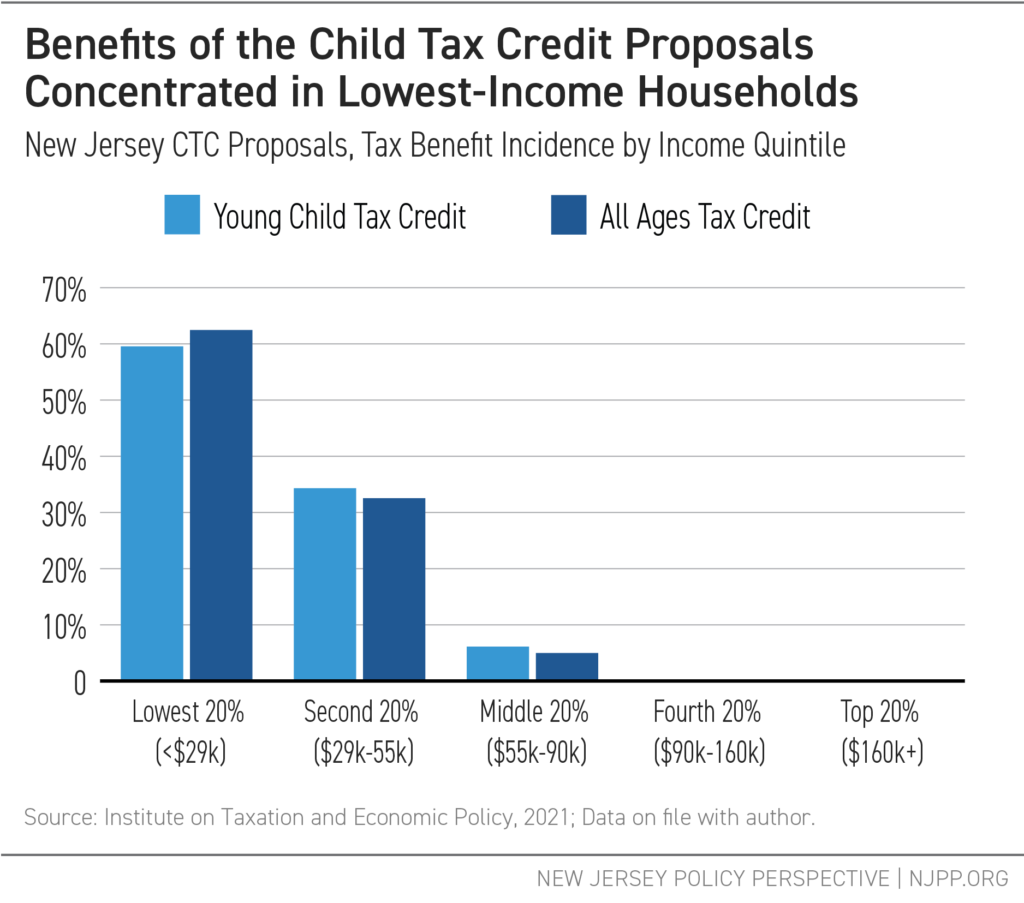

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

Itemized Deductions Nj Property Tax Deduction Credit Pub 4012 Tab F Pub 17 Chapters 21 Through 29 Nj Special Handling Federal 1040 Line 40 Schedule Ppt Download

Township Of Teaneck New Jersey Tax Deductions

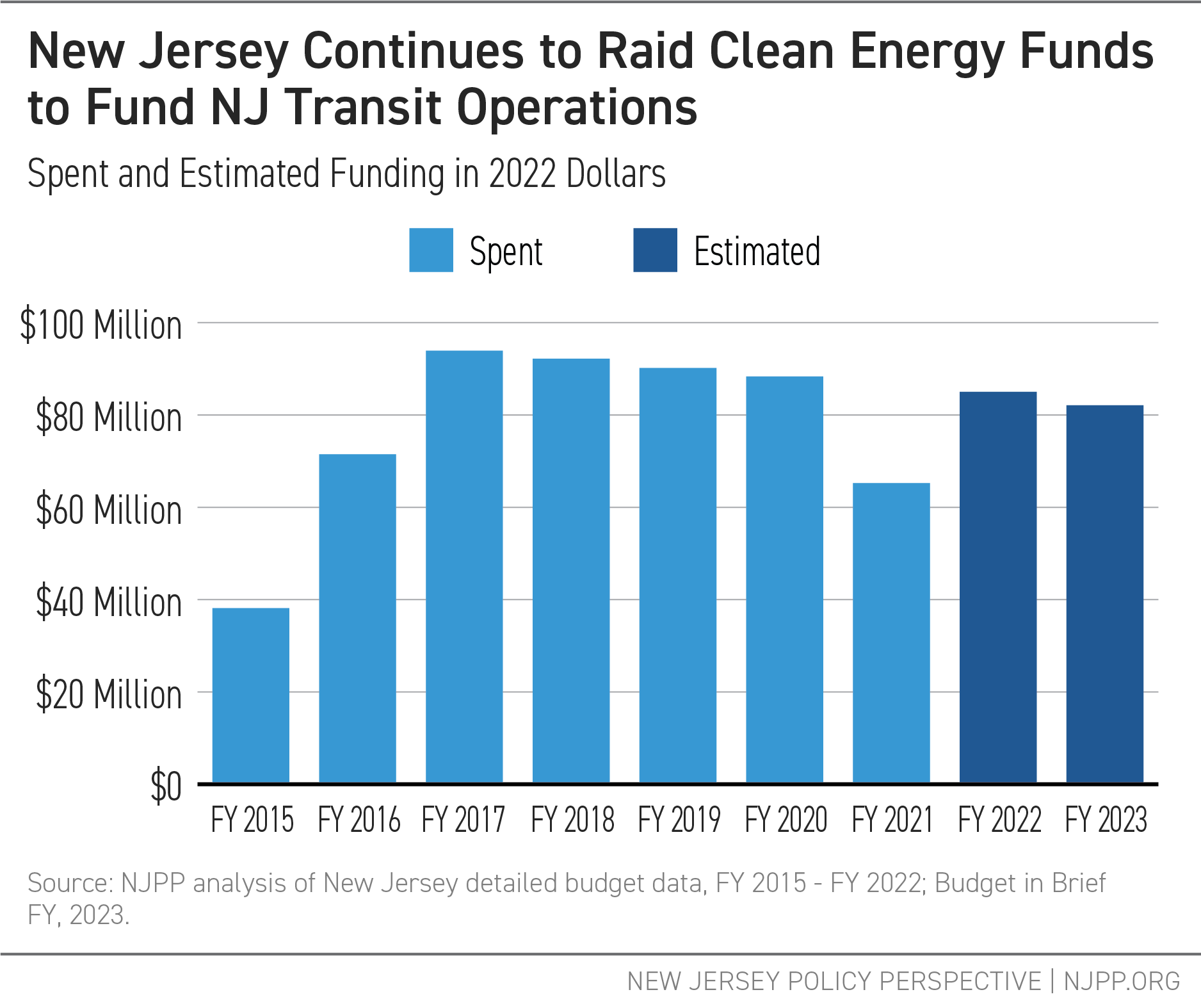

Tax And Budget Archives New Jersey Policy Perspective

Itemized Deductions Nj Property Tax Deduction Credit Pub 4012 Tab F Pub 17 Chapters 21 Through 29 Nj Special Handling Federal 1040 Line 40 Schedule Ppt Download

Itemized Deductions Nj Property Tax Deduction Credit Pub 4012 Tab F Pub 17 Chapters 21 Through 29 Nj Special Handling Federal 1040 Line 40 Schedule Ppt Download

Itemized Deductions Nj Property Tax Deduction Credit Pub 4012 Tab F Pub 17 Chapters 21 Through 29 Nj Special Handling Federal 1040 Line 40 Schedule Ppt Download

Completing Property Tax Reimbursement Ptr Application Nj Ptr Application Instructions Aka Senior Freeze Nj Tax Ty2014 V Ppt Download

Tax And Budget Archives New Jersey Policy Perspective

Itemized Deductions Nj Property Tax Deduction Credit Pub 4012 Tab F Pub 17 Chapters 21 Through 29 Nj Special Handling Federal 1040 Line 40 Schedule Ppt Download

New Jersey Voters 50 Need More Property Tax Relief

Completing Property Tax Reimbursement Ptr Application Nj Ptr Application Instructions Aka Senior Freeze Nj Tax Ty2014 V Ppt Download

Itemized Deductions Nj Property Tax Deduction Credit Pub 4012 Tab F Pub 17 Chapters 21 Through 29 Nj Special Handling Federal 1040 Line 40 Schedule Ppt Download

Completing Property Tax Reimbursement Ptr Application Nj Ptr Application Instructions Aka Senior Freeze Nj Tax Ty2014 V Ppt Download

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective